Listen to the audio version of this article below

- Interest rates are starting to rise again in the capital markets: the interest on Dutch 10-year government bonds turned positive again recently.

- The Central Planning Office expects the national debt in the Netherlands to rise to 90% of national income in the period up to 1960.

- However, in the short term, the Dutch government does not need to fear a sharp rise in interest rates, notes currency expert Joost Dirks of iBanFirst.

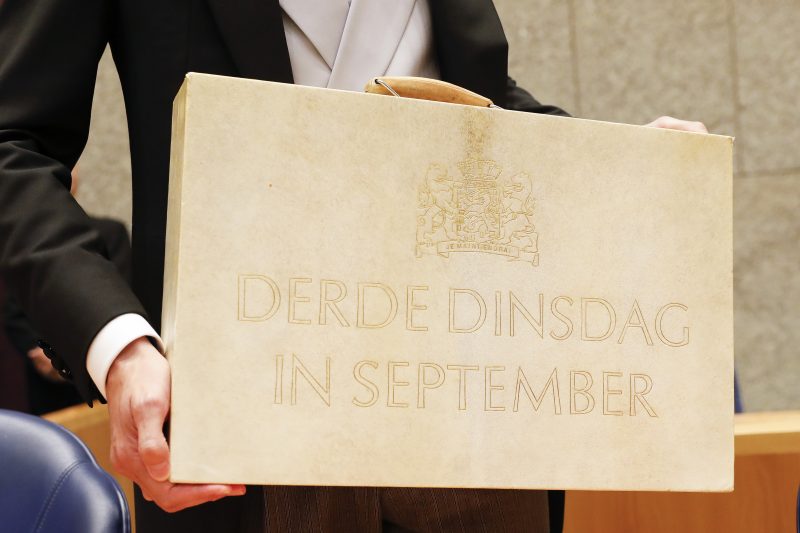

Analysis – The Dutch government would have had to start paying interest again since last week if the government issued new 10-year government bonds. Soon after the negative interest rate turned into a positive one, the European Central Bank also predicted that government debt could rise significantly in the future.

However, you don’t have to worry that a lot of the budget will soon be swallowed up by higher interest payments.

Government debt is expected to reach nearly 58 percent of national income by the end of this year. However, the new Rutte IV cabinet saves a lot of money to tackle major problems in areas such as climate and nitrogen.

The European Central Bank calculated that the ratio between the national debt and the size of the economy could expand to 92 percent in 2060 in the coming decades, a level well above the 60 percent stipulated in European financial rules.

The Netherlands is in a better financial position than many other European countries

However, there are two caveats to be made about this increase in government debt. In the first place, even in the CPB scenario, Dutch government finances compare favorably with those of other European countries. In France and Belgium, for example, the ratio between government debt and national income has already risen to more than 100%. In addition, a lot can happen in 38 years.

In 1990, for example, China’s economy was only 10 percent larger than that of the Netherlands. Looking back, it’s easy to say, but few people at the time expected that the country would grow into a global economic power that might rival the United States.

High interest rates in the short term is not a problem for the government

Also, the rise in interest rates in the bond markets is not a direct cause for concern. Since interest rates have fluctuated at a very low level for many years, the Netherlands has issued many bonds with very favorable interest rates. As a result, we only lost €3.4 billion in interest costs in the current year. This represents less than 1 percent of the total budget, or less than 200 euros per Dutch person.

Currently, the average term of bonds that finance government debt is eight years. Even if interest rates rise suddenly, that doesn’t immediately translate into much higher interest fees.

One consequence of higher interest rates is that the Euro may gain some strength. Admittedly, this can harm the international competitiveness of the export sector. But the Netherlands has grown as a transit and export country thanks to its entrepreneurial spirit and convenient location. If a coin’s advantage is to be the deciding factor for future success, some things go wrong.

Joost Derks is a currency specialist at iBanFirst. He has more than twenty years of experience in the currency world.

Avid music fanatic. Communicator. Social media expert. Award-winning bacon scholar. Alcohol fan.