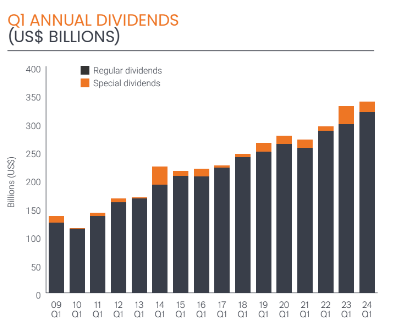

Global dividend payments rose to a record high in the first quarter That shows $339.2 billion Latest Janus Henderson Global Earnings Index. This represents an increase of no less than 6.8%.

The first quarter was seasonally quiet in many parts of the world, but first-quarter records were broken in Sweden and Canada, and an all-time quarterly record was set in the United States. Two very large companies, Meta and Alibaba, paid dividends for the first time ever, increasing total first-quarter earnings globally by 1.2 percentage points.

Netherlands is higher than all over the world

“Profit growth for Dutch companies in our index rose by 9.3% on an underlying basis in the first quarter, which is above the global average. This is a positive signal for the state of the Dutch economy,” says Sander van der Ent, President of Janus. Henderson in Benelux. “NXP Semiconductors made the strongest contribution to earnings growth in the Netherlands in the last quarter.”

US record

US dividend growth accelerated in the first quarter, rising to a new quarterly record high of $164.3 billion, up 7.0% on an underlying basis. Walt Disney's post-pandemic payout recovery and Meta and T-Mobile's first-quarter earnings were the main drivers of US dividend growth.

Limited earnings growth in Europe

The first quarter was seasonally quiet in Europe (except the UK) and was dominated by Switzerland, where CHF payouts fell – every Swiss company in the global dividend index increased its earnings per share, but share buybacks are very large (e.g. Novartis bought 5% (of its shares in 2023) exceeded earnings growth.

Danish shipping company Moller-Maersk cut its dividend very sharply, dragging down the European total in the first quarter. In the United Kingdom, most companies achieved flat or declining growth.

However, Janos Henderson expects the seasonally important second quarter to see strong growth in Europe.

Banks +12%

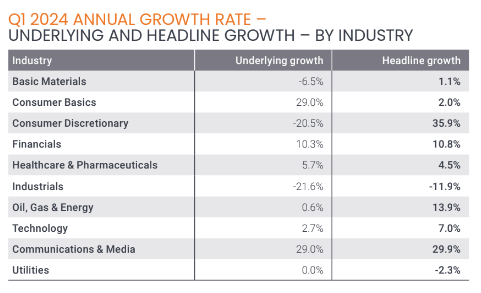

Banks accounted for a quarter of global growth in the first quarter, up 12.0%.

Of the 35 sectors monitored by Janus Henderson, only six declined, with very small declines excluding the transportation sector (mainly Mueller-Maersk). Most sectors posted strong single-digit fundamental gains.

Forecast: +5.0% for 2024

The first quarter was largely in line with Janus Henderson's expectations. The asset manager expects steady growth for the rest of the year. Janus Henderson did not change his forecast for total payouts of $1.72 trillion in 2024. The lower special dividend means the nominal increase will be 3.9% year-on-year, compared to an increase of 5.0% on a fundamental basis.

Jane Shumakev, global equity income team at Janus Henderson: “We have a reasonable view of payouts in the crucial second quarter, with seasonal peaks in Europe, Japan and the UK even though a handful of major companies announced significant dividend cuts, including Australian firm Woodside Energy, German chemicals company Bayer, and listed British mining group Glencore, the overall picture is one of continued resilience, especially in Europe, the United States and Canada.

In addition to the generally positive picture around the world, Meta and Alibaba's first dividends together will add nearly half a percentage point to global growth this year. Such companies realize that paying dividends is an important way to return capital to their investors, in addition to repurchasing shares.

Zombie specialist. Friendly twitter guru. Internet buff. Organizer. Coffee trailblazer. Lifelong problem solver. Certified travel enthusiast. Alcohol geek.