Did Apple’s expansion into the financial sector inspire Microsoft? Things get better even if the long-term goal looks different.

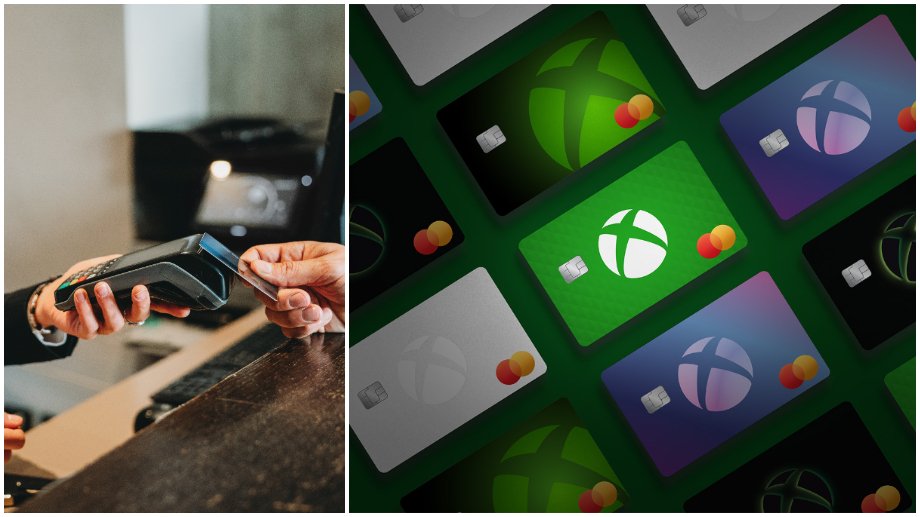

News: The Xbox Mastercard will launch on September 21.

- This credit card is issued in partnership with the US consumer bank Barclays and can be used like any other card for everyday purchases.

- Microsoft states on its website that it does not charge transaction fees.

- For now, the card will only be available in the US, similar to the launch of Apple Card. But who knows, we might benefit from it too one day.

in detail: Benefit is the right word, because the Xbox Mastercard offers the opportunity to earn points with every purchase.

- These points can then be used to purchase games and accessories from the Microsoft Store.

- So Microsoft is targeting gamers with this card.

- We note that although the case is not yet completed, the company put $69 billion on the table last year to acquire Activision Blizzard.

- The American giant also indicates that users can maximize their points by making purchases from various platforms, including Xbox and Microsoft, as well as partners such as Disney+ or Netflix.

Why such concern for their clients’ finances?

- It seems very strange that tech giants like Apple and Microsoft are partnering with financial giants to offer banking products to their customers.

- But what’s even more surprising is that Microsoft is taking this step now. Not everything goes according to plan at Apple, as far as its savings account is concerned.

- In the case of the gaming giant, we can imagine that Microsoft wants to increase the loyalty of its customers and players: the points system is an excellent way to achieve this.

- The fact that big tech companies don’t charge fees may convince some players.

(Shortcut ii.)

Evil tv scholar. Proud twitter aficionado. Travel ninja. Hipster-friendly zombie fanatic.