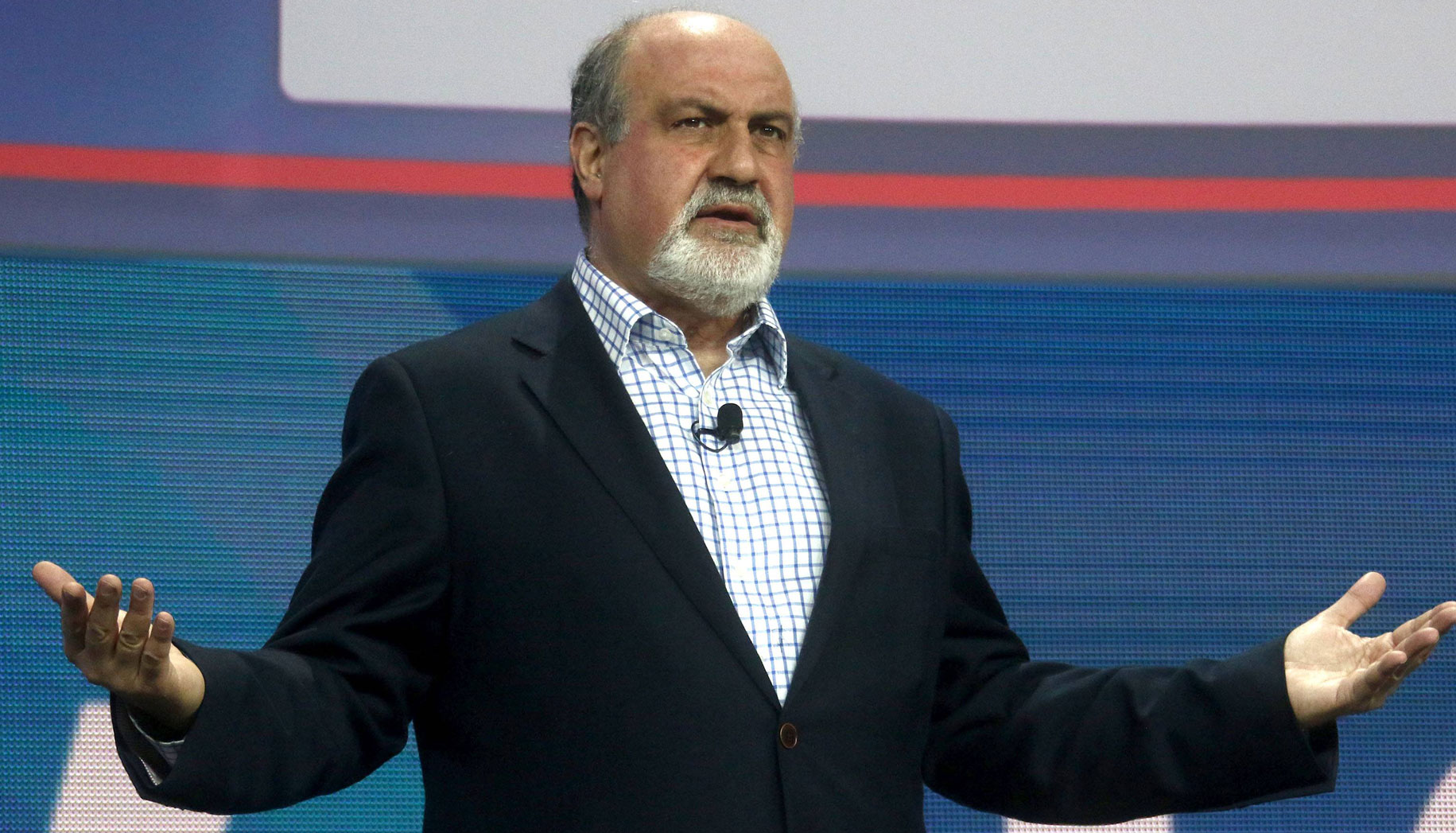

Years of zero interest rates in the US would have hurt the US economy and created speculative bubbles like Bitcoin. Nassim Nicholas Taleb, author of “The Black Swan,” said Thursday in an interview with CNBC.

Taleb continued, “We lived in a kind of Disneyland for about 15 years, which basically destroyed the economic structure. Imagine that: there are no interest rates.”

The former options trader and financial mathematician said, “Zero interest rates are hurting the economy for long periods of time. They create bubbles, they create tumors like Bitcoin, and lead to hedge funds that shouldn’t be there but have been for 15 years.”

Bitcoin student criticized before. He described cryptocurrency as an “unnecessary, low-interest product” and likened it to an “contagious disease.”

From “Disneyland” to normal economic life

Next week, the US Federal Reserve is expected to raise interest rates for the fifth time in 2022 to increase the cost of borrowing. The subsequent slowdown in economic activity is aimed at curbing the rising rate of inflation.

Black Swan said: “We have to return to normal economic life. People with experience remember that there was such a thing as the discount rate. Investments also had to generate cash flow. The new generation could no longer imagine that.” – the author as well.

The Federal Reserve kept interest rates in the range of 0 to 0.25 percent between 2008 and 2015. Extremely low interest rates were used especially during the global financial crisis.

In the world’s bestselling book The Black Swan, Taleb deals with the intense effects of rare and unexpected escape events. He refers to such events as the “black swan”. For Taleb, the 2008 financial crisis is also part of it.

Lifelong foodaholic. Professional twitter expert. Organizer. Award-winning internet geek. Coffee advocate.