The US economy and the eurozone economy have maintained a steady pace of progress for decades. They each have an equal population: 332 million people in the United States compared to 344 million people in the Eurozone. Until 1996, Europe had to assume this role. On the other hand, the US economy is almost twice the size of the Eurozone economy. French investment bank Natixis investigated what happened after 1996.

- When comparing trends in GDP in the US and the Eurozone, we see that from 1996 onwards growth in the US has become stronger than growth in the Eurozone.

What happened around 1996?

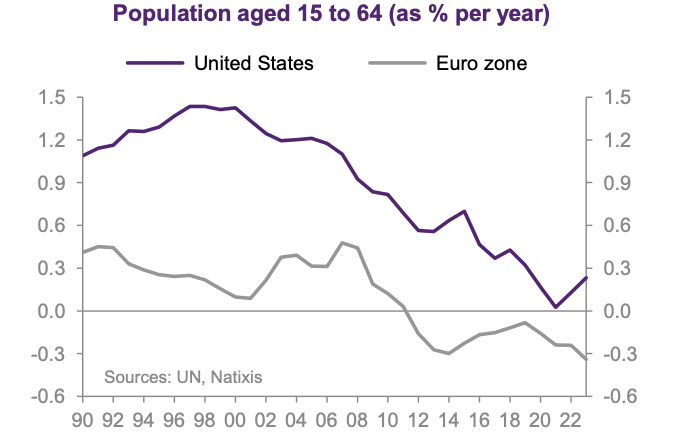

demographics

- Demographics in the United States remained more dynamic than in the Eurozone, allowing employment to grow faster in the United States.

- With the exception of Covid 2021, the American population between the ages of 15 and 64 has continued to grow.

- In the eurozone, deflation began in 2011.

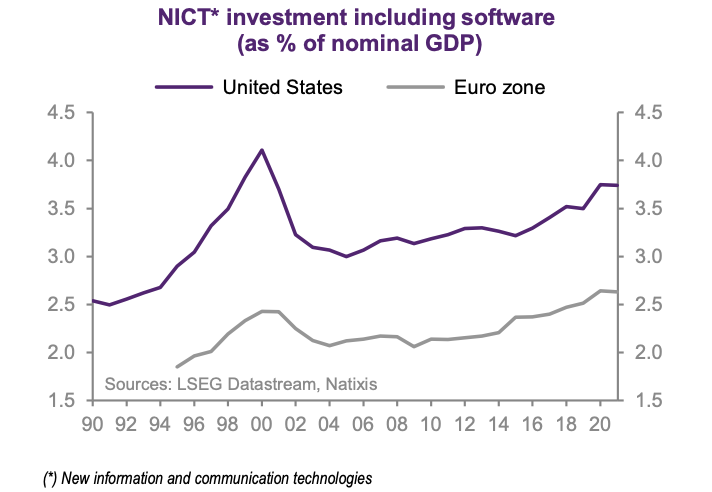

Capital growth

- The growth of capital accumulation (excluding housing) in the United States was faster than in the euro area.

- Comparing the growth gap between the US and the Eurozone, the capital stock grew by 50% in the US compared to the Eurozone between 1990 and 2022.

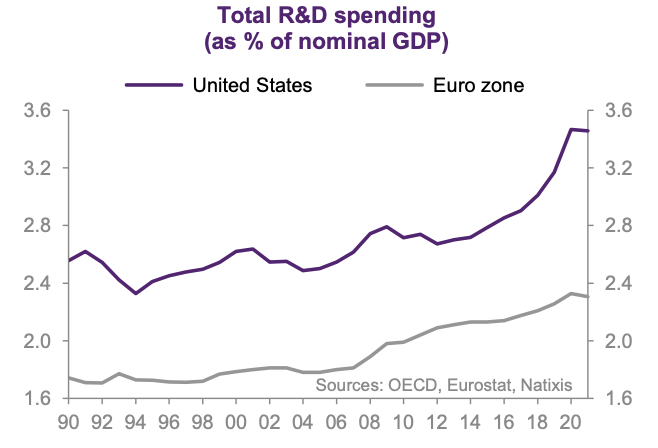

technology

- Total factor productivity (technological progress) in the United States began to grow more rapidly than its counterpart in the eurozone.

- The level of investment in new technologies, the level of spending on research and development, etc., were several times higher in the United States than in the euro area.

In summary. The cumulative growth advantage of the United States (38% between 1990 and 2023) can be explained as follows:

- The difference in employment growth favors the United States (15%)

- The difference in capital growth favors the United States (15%)

- The cumulative growth differential in total factor productivity favors the United States (8%).

Avid music fanatic. Communicator. Social media expert. Award-winning bacon scholar. Alcohol fan.