Someone had to buy the Incredibly Spiking US Gross National Debt. Here’s who.

By Wolf Richter for WOLF STREET.

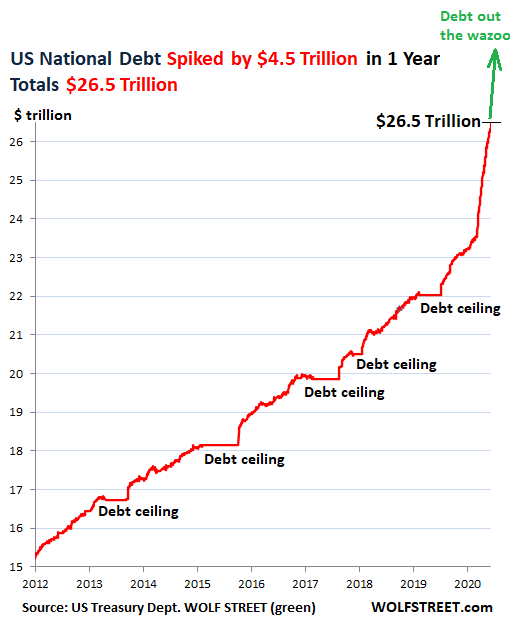

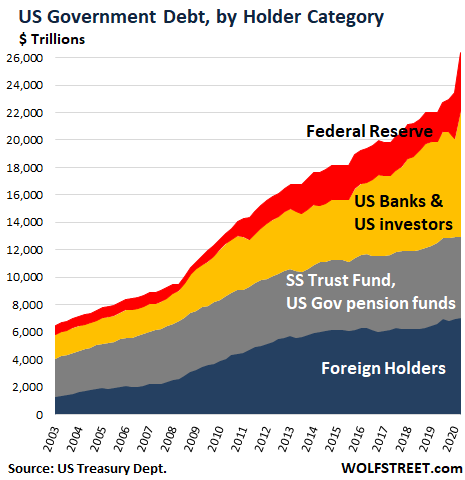

Remember the ridiculous and quaint charade around the “Debt Ceiling” in Congress and the White House? Me neither. But those were the Good Times. So what we now have is the Pandemic Economy with the Incredibly Spiking US Gross National Debt, which spiked incredibly by $4.45 trillion over the past 12 months, to $26.5 trillion. WHOOSH go the trillions, flying by.

But here is the thing: These are all Treasury Securities – and someone had to buy them, every single one of them. But who?

With today’s release by the Treasury Department’s Treasury International Capital (TIC) data through June 30, and with other data released by the Federal Reserve, we can piece together the puzzle who bought those $4.45 trillion in Treasury Securities over the past 12 months.

Foreign investors: nibbling on it.

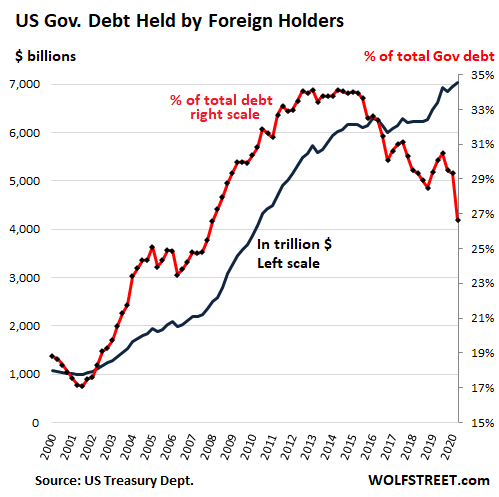

Foreign central banks, governments, companies, commercial banks, bond funds, other funds, and individuals, all combined added $90 billion to their holdings in June compared to May. Over the 12-month period through June, they added $413 billion. They now hold a total of $7.04 trillion, a huge record pile.

But given the incredibly spiking US Treasury debt ($26.45 trillion on June 30), their share of this debt plunged to just 26.6% — the lowest since 2008. The quarterly chart shows foreign holdings in billion dollars (blue line, left scale); and the percentage of total US debt (red line, right scale):

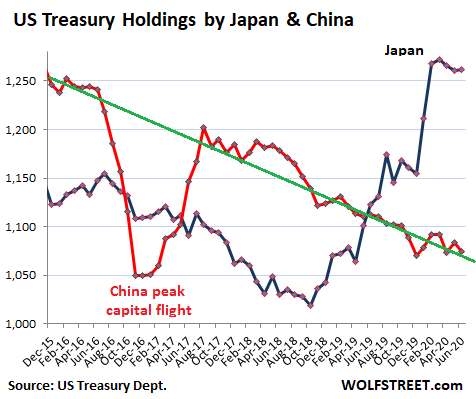

Japan and China, the two largest foreign creditors of the US, combined held 8.8% of the US debt, the lowest share going back many years. Back at the end of 2015, their combined holdings were still 12.8% of the total US debt.

Japan maintained its holdings in June for the third month in a row at $1.26 trillion, but over the 12-month period increased its holdings by $138 billion.

China cut its holdings in June by $9 billion, to $1.07 trillion, and over the 12-month period by $38 billion, which follows the trend since 2015, with exception of the V-shaped plunge during peak-capital flight, and the recovery afterwards:

The next 10 largest foreign holders include many tax havens and financial centers, such as the UK (City of London financial center), Belgium (home to Euroclear), Ireland, the fertile breeding ground of mailbox-entities of many US corporations established there to dodge US taxes. The Treasuries that US corporations hold in those mail-box accounts established in Ireland count as Irish holdings. In parenthesis are Treasury holdings as of June 2019:

- UK (“City of London” financial center): $446 billion ($341 billion)

- Ireland: $330 billion ($261 billion)

- Luxembourg: $268 billion ($230 billion)

- Hong Kong: $266 billion ($217 billion)

- Brazil: $264 billion ($312 billion)

- Switzerland: $247 billion ($232 billion)

- Cayman Islands: $222 billion ($225 billion)

- Belgium: $219 billion ($200 billion)

- Taiwan: $205 billion ($175 billion)

- India: $183 billion ($163 billion)

Despite the mega-trade deficits that the US has with Mexico and Germany, their holdings of US Treasury securities are relatively small: Germany held $80 billion and Mexico $47 billion.

US government funds

The Social Security Trust Fund, pension funds for federal civilian employees, pension funds for the US military, and other government funds added $50 billion in June and $112 billion over the 12-month period to their holdings, which reached $5.95 trillion, or about 22.5% of total US debt.

These Treasury securities, often called “debt held internally,” represent assets that belong to the beneficiaries of those funds. They’re a true debt of the US, and they don’t go away – “it doesn’t count because we owe this to ourselves,” the silly line goes – just because American beneficiaries are indirectly the holders of these assets.

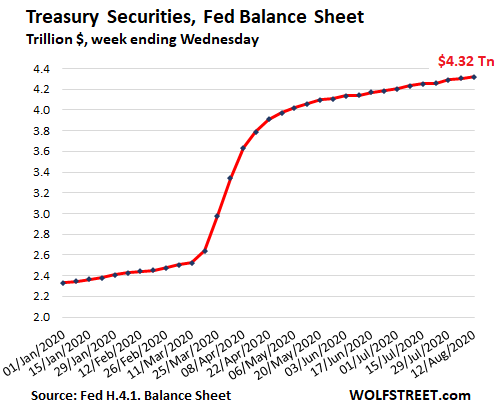

The Federal Reserve loads up.

In June, the Fed added just $95 billion to its pile of Treasuries, having already cut back its purchases, after having added $1.6 trillion from March 11 through the end of May, bringing its total holdings at the end of June to $4.2 trillion. It holds about 15.9% of the US debt.

Over the 12-month period, the Fed added $2.1 trillion in Treasuries to its holdings, about doubling its pile over the period (weekly chart through August 12, here’s my analysis of the Fed’s latest asset purchases):

US Commercial Banks load up too.

Just over the month of June, US commercial banks added $121 billion in Treasury securities, to a total of $1.07 trillion, according to the Federal Reserve’s data release on bank balance sheets. This brought the 12-month increase to $220 billion. They hold about 4.0% of the total US debt.

Other US entities & individuals

That’s everything that is not included in the above: US institutional investors, US bond funds, pension funds, insurers, individuals directly or indirectly, cash-rich US corporations, private equity firms, and highly leveraged hedge funds engaging in complex trades – such as long cash Treasuries and short Treasury futures, which blew up in March and which were bailed out by the Fed, as was confirmed in an editorial by William Dudley, former president of the New York Fed.

They all piled on Treasury securities, possibly in panic, possibly hoping to be able to sell them at even lower yields and even higher prices to the Primary Dealers to sell to the Fed.

By the end of June, over the course of the tumultuous second quarter, these US entities added $1.6 trillion, after having been big sellers of Treasuries in prior quarters. This brought their total holdings to a mega-record of $8.13 trillion – about 31% of the total US debt.

The chart shows Treasury holdings by holder. US banks and other US entities are combined into the yellow field, which, along with the Fed, bought the majority of the Incredibly Spiking US Debt in Q2:

Over 30 million people lost their jobs between mid-March and mid-May. But the wealth of America’s 600+ billionaires ballooned by $434 billion. How did this happen? Listen to my podcast… THE WOLF STREET REPORT: The Rich Got Richer in the Pandemic. Why?

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Avid music fanatic. Communicator. Social media expert. Award-winning bacon scholar. Alcohol fan.